The FDA finalized the rule after receiving and reviewing more than 1,000 public comments on the proposed rule issued on October 20, 2021. Comments submitted by consumers, professional associations, hearing aid manufacturers, public health organizations and advocacy groups, members of Congress, state agencies, and other stakeholders are summarized in the final ruling, along with the FDA’s respective responses.

Furthermore, the new documents amend existing rules that apply to prescription hearing aids for consistency with the new OTC category, it repeals the conditions for sale for hearing aids, and it includes provisions that address some of the effects of the FDA OTC hearing aid regulations on state regulation of hearing aids. The expectation is to have the first available OTC Hearing Aids available in stores as soon as mid-October 2022.

The FDA also issued the final Regulatory Requirements for Hearing Aid Devices and Personal Sound Amplification Products, clarifying the differences between hearing aids, which are medical devices; personal sound amplification products; and the new category of OTC hearing aids, which can be purchased directly from stores or online.

As expected, the hearing aid manufacturers, suppliers, distributors, and hearing health professionals, strongly supported the FDA OTC rule. They feel they were able to provide guidance during these past five years, and basically have been preparing for this moment. In fact, the first products from the leading hearing-aid brands have already been registered as OTC products and are expecting the required approval. GN Group, which owns hearing aid brands Resound and Beltone, together with Jabra, the communications and all-in-one hearing enhancement consumer brand, was among the first companies to submit .

I respect too much the audiology industry and the medical professionals that care for our hearing, but in general I have looked at this topic from the perspective of the consumer electronics industry. I wrote an editorial discussing that perspective in my November 2021 article "Reading Glasses and Hearing Aids. Smart or FDA-Approved. Pick One," which is available online and continues to generate daily visits and interesting correspondence.

As I write there, many "consumer" audio manufacturers and the larger technology companies see this as an opportunity to pursue the "OTC hearing aids" as an extension of their strategic market share and ecosystem goals. Most of those companies are not familiar with the complexities of global regulatory environments for medical and health products, and many have foolishly believed at some point that this would be like any other market "ready to be disrupted."

The 2022 FDA OTC Rule makes it clear that this is not an environment for irresponsible experimentation and in some way, it discourages many of those players - particularly the many Asian manufacturers that have been testing the field in unregulated markets - from applying for OTC registration. As I predicted in my article last year.

But with the process now moving forward in the US, at least companies who are invested in these technologies and specifically in "hearables" and hearing augmentation, will now have more solid ground to base their go-to-market strategies. Addressing or totally ignoring the OTC registration. I truly believe that hearing augmentation has more consumer appeal and market potential and that augmentation will be the field where companies such as Apple will be investing their resources.

So, it is still too soon to say what will change in the next year and the following years. I know I'll be asking questions at forthcoming trade shows and I'll do my best to share some of the statements and opinions I get. What I can write confidently for now, is about the signs that are already being sent by the hearing aid companies, which have made announcements of what they think they can offer as "affordable" OTC Hearing Aids.

The first known example was not very encouraging. The Lexie B1 Hearing Aids Powered by Bose, announced at the end of July, will cost $899 — a fraction of the price of most traditional hearing aids, but still much more expensive than premium true wireless earbuds with more advanced sound processing features.

Hearings Aids

I don't need hearing aids, yet. But if I did, I would seriously consider all the available options from the market, and after the selection process I would likely look for an option to "lease" or "rent" - not buy - a pair. In fact, I would be very receptive to a company that would offer a "subscription" model, which would include assistance and hardware updates. And the reason is simple. Unlike my normal $199 earbuds with the best available options, and that I am likely to replace every two years (at least), the best hearings aids that really offer the latest and best features for hearing assistance cost $4000, $5000, and more.

And while for my earbuds I have dozen of similar options and I can choose to buy Apple's AirPods knowing that I have acquired the best product available in any color as long as its white, the $4000 hearings aids are available in at least 10 different basic options, before discussing aesthetics and the fact that the best available model today with Bluetooth doesn't yet support Bluetooth LE Audio (tough luck), which means they will be obsolete in a year... or even a few months.

I have been following the hearing aids industry more carefully only for the past 8 years or so, and I cannot help looking at product announcements from my product development and marketing-focused perspective. And I've noticed that the major brands regularly update the available platforms with something new, something better, anytime they can. And I also noted that with geographical variants - because of the public health systems available in some countries that require approval for specific models with certain specific parameters - these brands actually manage an incredibly large number of base SKUs, plus accessories. I can clearly see that their pricing strategy is strongly conditioned from the start from that overhead.

I can applaud the strong investments in R&D and respect the efforts these brands put into updating the offering to serve the market with the latest technology. There's just a problem. After spending $4000 USD from my pocket - or even if discounted from my health insurance plan (or even 100% welfare supported, for those in Europe) - I have no choice but stick with what I've got for a few years. And I'm afraid I would feel really bad when I would see a better model with even more attractive options and irresistible designs, being announced every six months.

How could I not be compelled to buy something new when there's a new model with better party mode filtering, new AI-assisted tools, or new Bluetooth LE Audio features being launched? I understand that medical hearing aids, once tuned for my personal needs, should do the work decently for some time and we shouldn't look at it as a disposable category. The problem is, with more affordable OTC products, I'm not so certain that wouldn't be the case for those who can. In fact, creating consistent renewal cycles could be very well part of a very successful OTC strategy, with lower prices and much larger volumes, serving many more users. According to the FDA, reaching out to more users should be the goal.

This is something that apparently hearing aids companies don't even care about because they live in an environment that has been immune to "consumer" psychology and behaviors. And that is probably why their products have helped create the social stigma that many experts have denounced. But with the creation of the OTC category for hearing aids and eventually hearables, those rules need to apply - and that's where I think consumer electronic companies can build their differentiation strategies. Those who understand the value of building a loyal community.

Those companies that discard concepts like "brand loyalty" and confuse it with "consumerism" shouldn't attempt to enter some product categories.

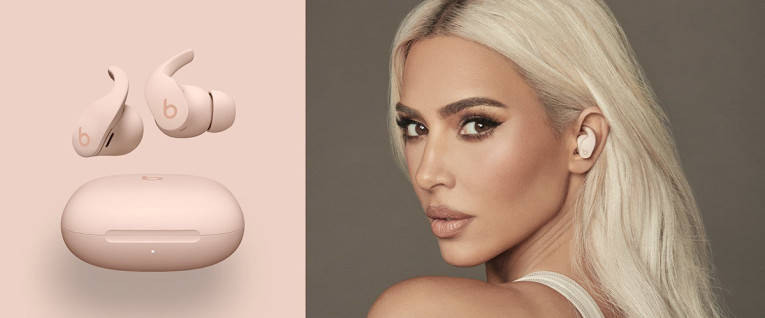

Anyone doubting the power of community and brand loyalty just needs to look at the recent example of the Beats Fit Pro true wireless noise cancelling earbuds and the (now sold out) Beat x Kim (Kardashian) in "neutral skin tones." Apple/Beats sold the full initial inventory in their own online store (and shortly after on Amazon), in just 24 hours. They probably sold more $199 TWS earbuds in one day than the whole industry did that month - and certainly way more than all the hearing aids sold during multiple months. If they didn't, it’s because someone failed to anticipate the power of Kim Kardashian and her 400 million followers on social media - and that person is probably writing a long report explaining what happened...