While the Amazon Echo is serving as the "reference design" for many companies wishing to capitalize on the voice-control hype - and Alexa Voice Service (AVS) certainly provides one of the better supported and thriving development ecosystems - Google seems to have better understood this "trojan horse" strategy to promote its Google Home initiative by offering Chromecast to the consumer electronics industry, focusing on the audio and video product category. Currently visible in products from hundreds of companies, including giants such as Sony, Chromecast integration allows televisions, integrated receivers, soundbars, portable speakers and all sorts of home entertainment devices to activate and control connected services such as streaming music and multi-room features, while "also" providing access to Google's Voice Personal Assistant. Still, even though Chromecast is highly successful as a strategy, consumers remain largely indifferent to it. Consumers simply want to access and stream Spotify, they have no idea what platform they are using. And the voice-control features remain "nice-to-have" but not key for purchasing behavior.

Apple came later to the game, but refined this strategy extremely well. After all, they already had Siri in all their devices and they knew Siri is not the killer app when consumers buy an iPhone or an iPad. Apple also had an evolved smart home strategy with HomeKit, and has experience in the "home entertainment hub" strategy with Apple TV. Apple even introduced Siri voice control functionalities on its fourth generation Apple TV, but it was not a far-field solution, and depended on a very clumsy "talk to the remote" concept, which does the trick, but is perceived as silly by the user - the reason to use voice commands is precisely because you don't want to reach out for the remote! After the Amazon Echo was launched, Apple recognized that far-field voice interaction was the next logical step and could be the key for home adoption.

Apple's HomePod refines the concept to create a simple proposition that simultaneously can offer the best music listening experience, and the best combination of digital processing and acoustical optimization, to optimize audio playback and enable far-field voice capture and Siri-powered recognition. Essentially, Apple is targeting the "wireless home audio" vision, which the company knows is something consumer's will buy, while HomePod paves the way for consumers to discover the full potential of other HomeKit connected devices... and quickly grow from there.

Apple defined the strategy as "Reinvent Home Music." While the HomePod speaker can be controlled also via a remote iOS app, it is significant that Apple wants to make sure that the concept will be introduced first in those countries where consumers will be able to leverage its Siri voice-interaction features - hence the initial limited launch to English-speaking countries (US, UK, and Australia) in December 2017, before they make it available elsewhere. The remaining announced OS, AirPlay 2 and fundamental API updates, including for HomeKit, will do the rest.

A recent research by the consumer electronics team at Futuresource Consulting, helps to connect the dots on this strategy. According to the just published Smart Home Consumer Study , the smart home is poised to emerge by stealth as consumers who install their first device will be keen on automating further. "The research reveals that almost 1 in 3 consumers live in homes where at least one smart home device has been installed. Over 4,000 consumers in France, Germany, UK, and the US were surveyed on smart home devices, appliance ownership, perceptions and purchase intent. Voice Personal Assistant (VPA) speakers were included, looking at both current and future adoption."

Among the four countries surveyed, the US showed the highest smart home penetration, with 38% of respondents claiming to be living in a home with at least one smart home device installed. In Germany, respondents seem more resistant to the idea of adopting smart home devices, as only 1 in 5 have installed at least one smart home device in their home.

According to Filipe Oliveira, Analyst at Futuresource Consulting, "Smart lighting and smart thermostats are among the most popular smart home devices and are common first steps into the smart home. However, it is home security that more respondents report as the first smart home device that they have installed. Products that fall under climate control are growing but our survey revealed that this is a fragmented category with relatively low levels of brand recognition, a challenge to manufacturers in this field."

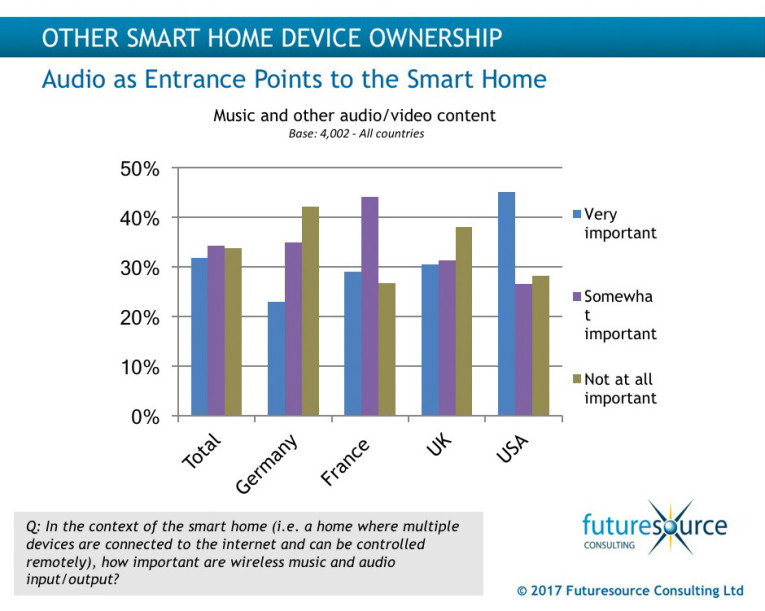

According to this latest report, audio and video content is often the first step into automation in the home. Two in three respondents considered music and other audio/video content to be important in the context of the smart home. "The results provide evidence that the smart home can grow by stealth as users who installed one device are more likely to want to automate their homes further," continued Oliveira. "Across all segments, 30% of consumers expect to control more of their homes wirelessly in the near future. However, the number is substantially higher among those who already own at least one smart home device, with 89% of advanced users expecting to control more of their homes wirelessly in the next 6-12 months, the report breaks this down for each segment."

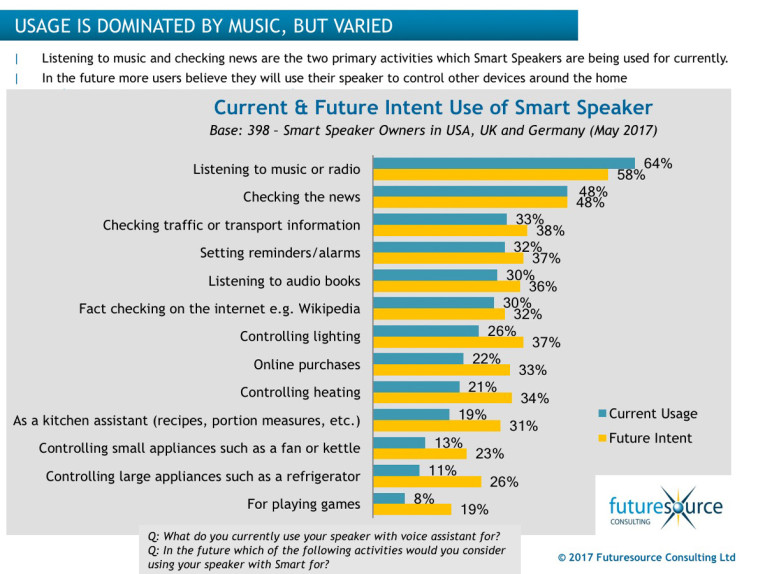

The Futuresouce research recognizes VPA speakers can be an important driver of smart home adoption. While the most common use of the devices is music streaming, a substantial number of respondents claimed to use their VPA speakers for home automation purposes such as controlling the heating or the lighting. Futuresource also adds that bundling seems to be an important retail opportunity as "a small but not negligible number of consumers report that they acquired their smart home devices bundled with a VPA speaker."

This article was originally published for The Audio Voice weekly newsletter. Register here!