The Recording Industry Association of America (RIAA) published its annual Year-End Sales & Shipments report for 2015 and the results show that digital music subscription services reached new all-time highs, generating more than $1 billion in revenues for the first time, and averaging nearly 11 million paid subscriptions for the year. Revenues from vinyl albums also increased and represented a record $416 million.

The Recording Industry Association of America (RIAA), the record industry trade organization published its 2015 year-end music sales & shipments report, offering a unique and comprehensive look at the state of the U.S. music business. A quick snapshot reveals that streaming, now the largest revenue-generator for the industry, helped grow the overall business by just shy of 1% year-over-year, with paid subscriptions leading the way.

In its notes on the 2015 Statistics, Joshua P. Friedlander, RIAA’s Senior Vice President, Strategic Data Analysis highlights the fact that the U.S. recorded music industry continued its transition to more digital and more diverse revenue streams in 2015. Overall revenues in 2015 were up 0.9% to $7.0 billion at estimated retail value. The continued growth of revenues from streaming services offset declines in sales of digital downloads and physical product. And at wholesale value, the market was up 0.8% to $4.95 billion – the fifth consecutive year that the market has grown at wholesale value.

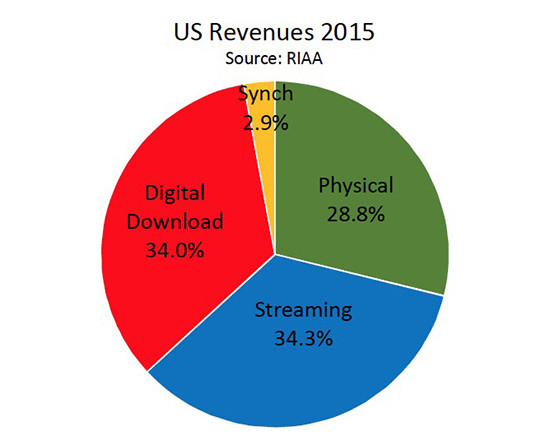

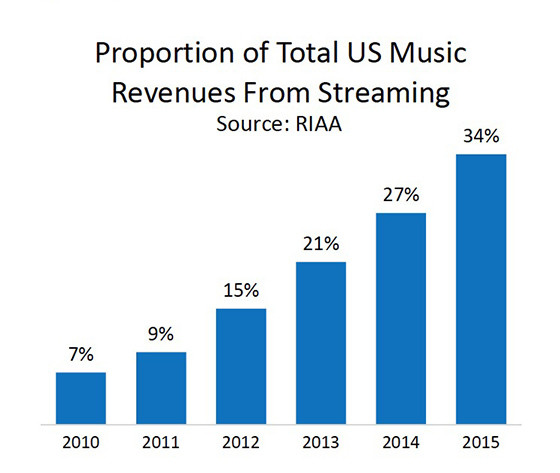

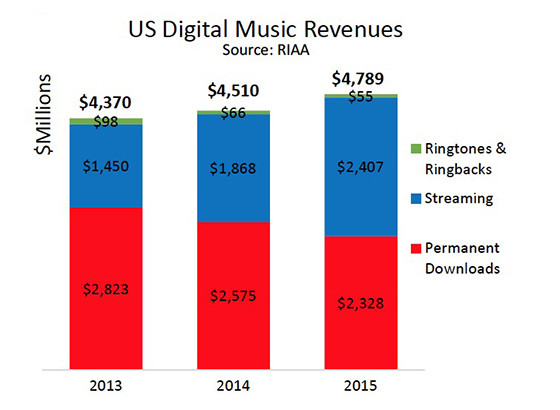

2015 was a milestone year for streaming music. For the first time, streaming was the largest component of industry revenues, comprising 34.3% of the market, just slightly higher than digital downloads. The streaming category includes revenues from subscription services (such as paid versions of Spotify, TIDAL, and Apple Music, among others), streaming radio service revenues that are distributed by SoundExchange (like Pandora, SiriusXM, and other Internet radio), and other non-subscription on-demand streaming services (such as YouTube, Vevo, and ad-supported Spotify).

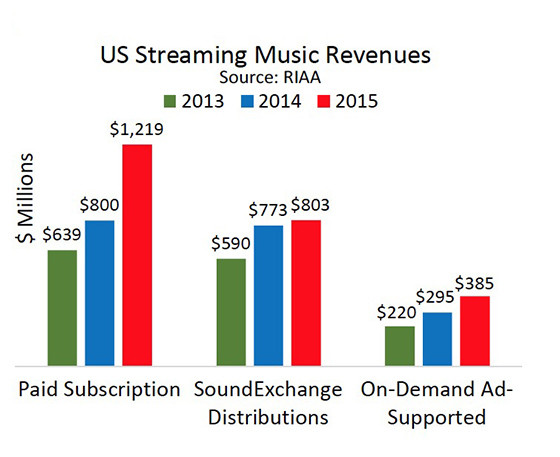

All parts of the streaming music market grew in 2015, and total streaming revenues exceeded $2 billion for the first time ever. Combining all categories of streaming music (subscription, ad-supported on-demand, and SoundExchange distributions), revenues grew 29% to $2.4 billion.

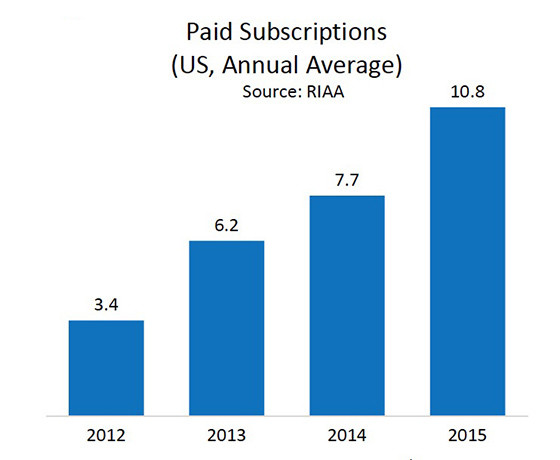

Paid subscription services were the biggest – and fastest growing – portion of the streaming market. The launch of new services like TIDAL and Apple Music made this one of the most watched and talked about spaces in the industry. In 2015, revenues from paid subscriptions grew 52% to $1.2 billion. At the same time, the number of paid subscriptions grew 40% to an average of 10.8 million for the full year.

SoundExchange distributions grew 4% to $803 million, and on-demand ad-supported streaming grew 31% y-o-y to $385 million. Digital accounted for 70% of the overall market by value, compared with 67% in 2014 (note Synchronization excluded from this figure). Even though digital download revenues (including digital tracks and albums) declined 10% to $2.3 billion, the total value of digitally distributed formats was up 6% to $4.8 billion, compared to $4.5 billion in 2014.

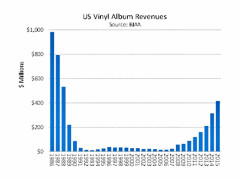

Total value of shipments in physical formats was $2.0 billion, down 10% versus the prior year. Vinyl LPs were up 32% by value, and at $416 million were at their highest level since 1988. Synchronization royalties were $203 million, up 7% versus the prior year.

Overall, the data for 2015 shows a music industry that continues to adopt digital distribution platforms for the majority of its revenues. While overall revenue levels were only up slightly, large shifts continued to occur under the surface as streaming continued to increase its market share. In 2015, the industry had the most balanced revenue mix in recent history, with just about 1/3 of revenues coming from each of the major platform categories: streaming, permanent downloads, and physical sales.

Vinyl continues to grow

As the RIAA also highlights, vinyl continues to surprise the industry, even though, as the trade association points out, “vinyl remains a niche, but it’s not insignificant. It continues to be a major bright spot for the industry. Revenues from vinyl albums were $416 million in 2015 – the last year they were that high was 1988!”

Also, for the second year in a row, vinyl revenues are higher than the revenues the industry receives from the billions of streams on ad-supported, on-demand services like YouTube, free Spotify, and others. Vinyl albums were just 6% of the overall retail music market (by value) in 2015. Small, but not insignificant. And as a percentage of physical revenues, that number shoots to 21%. Helping vinyl sales is the fact that recording companies are “bundling” digital codes available on some vinyl albums so consumers can download digital files as well.

Also, for the second year in a row, vinyl revenues are higher than the revenues the industry receives from the billions of streams on ad-supported, on-demand services like YouTube, free Spotify, and others. Vinyl albums were just 6% of the overall retail music market (by value) in 2015. Small, but not insignificant. And as a percentage of physical revenues, that number shoots to 21%. Helping vinyl sales is the fact that recording companies are “bundling” digital codes available on some vinyl albums so consumers can download digital files as well.State Of The Music Business

Offering additional comments, Cary Sherman, RIAA’s Chairman & CEO, adds that “the numbers and data reflect a business that continues to undergo considerable changes in consumer behavior and business models.”

“The music industry is now a digital business, deriving more than 70% of its revenues from a wide array of digital platforms and formats. The share of revenues from those digital formats surpasses that of any other creative industry,” he writes. Without mentioning Apple Music, Cary Sherman also notes, “In 2015, digital music subscription services reached new all-time highs, generating more than $1 billion in revenues for the first time, and averaging nearly 11 million paid subscriptions for the year. Heading into 2016, the number of subscriptions swelled even higher — more than 13 million by the end of December — holding great promise for this year.”

www.riaa.com/reports/